Deductions are a big problem at Swank Inc., one of the world’s largest manufacturers and distributors of men’s accessories. “I think that’s probably the biggest issue that we face on an ongoing basis,” said general credit manager Mark Tuniewicz, CCE. “Customers have complex systems to ensure that their vendors follow their rules, such as shipping on time or using a particular set of EDI codes. The fees can range from $50 to $100, to 5 to 10 percent of the total purchase cost,” he said. “It’s a huge profitability impact.”

The issue is so important that the company has formed a permanent task force with representatives from the returns department, distribution, customer service, the credit department, senior management and information technology.

According to Dan Raftery, president of Bannockburn, IL-based Prime Consulting Group, Inc., deductions are now at 10 percent of sales, up from 8 percent in 1998. Furthermore, according to a survey that Prime Consulting Group did for the Grocery Manufacturers of America last fall, 60 percent of companies had deduction levels greater than 10 percent last year, compared to just 34 percent in 1999.

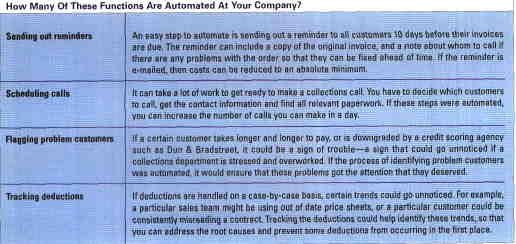

“Companies are confronting this problem with automation. Deduction management systems are now used by 92 percent of the companies surveyed—p from 71 percent two years ago, when the previous survey was taken. Companies are split evenly between building in-house systems and using third-party systems,” Raftery commented.

Read full article in Business Credit, a publication of the National Association of Credit Management. (Paid subscription required.)